Alternative Assets

Alternative Assets. Some 'alternative' to these typical traditional investment choices. Alternative assets typically refer to investments that fall outside of the traditional asset classes commonly accessed by most investors, such as stocks, bonds, or cash investments.

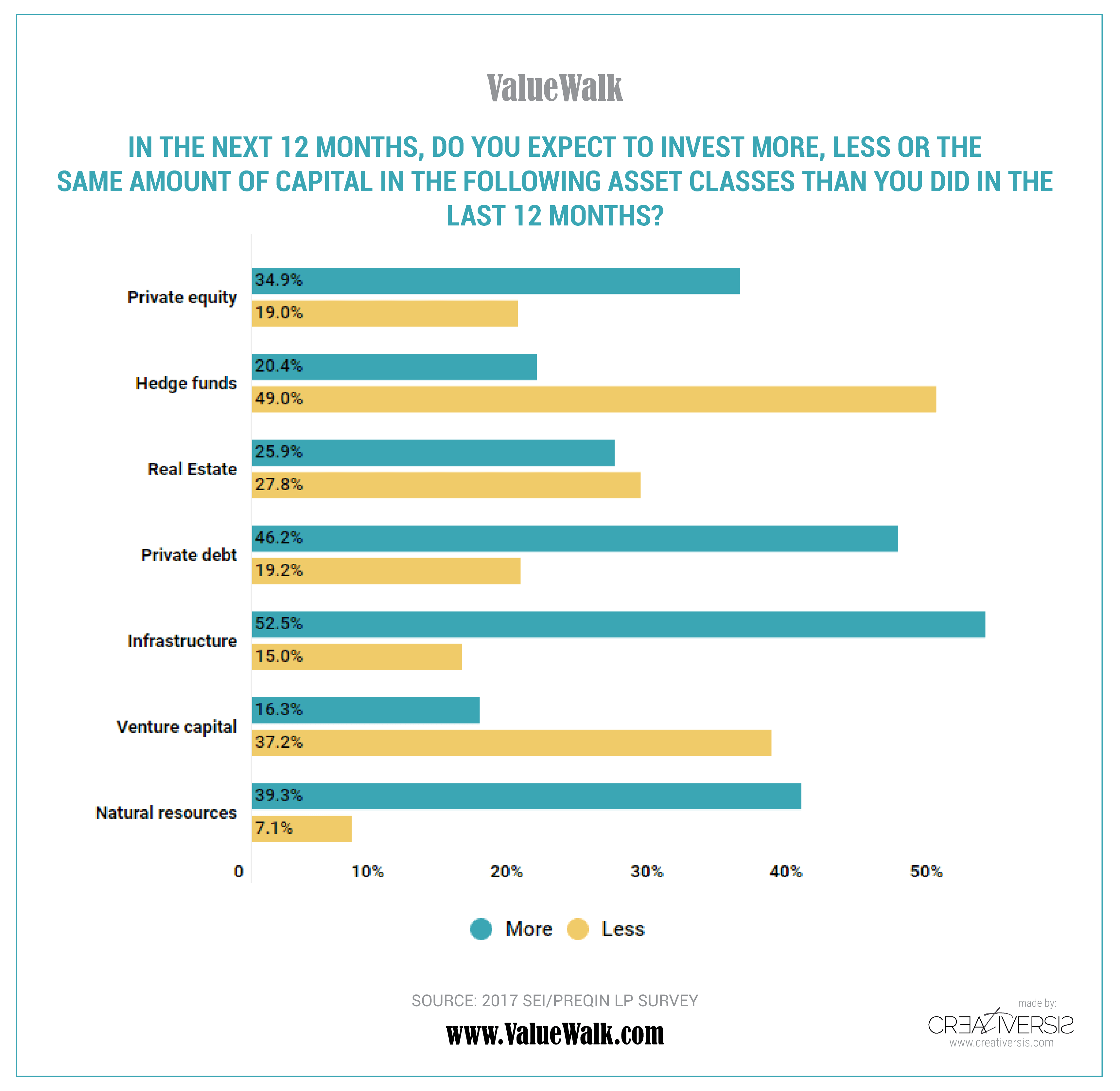

Alternative assets usually encompass the asset classes private equity, hedge funds and real estate.

Alternative assets are any assets that are not stocks, bonds or cash, such as bitcoin, property, rare art Interest in alternative asset investing — or "alts," as industry people say — has grown since the.

Alternative assets are well known as an attractive way to diversify and enhance returns, but as market conditions change and investment options shift, investors and asset managers should reexamine their. There is no uniform definition of alternative assets or definitive list of alternative assets - it will evolve over time as Alternative reality: The risks and opportunities of investing in alternative assets. Последние твиты от Alternative Assets (@altassetsclub). Alternative investments or asset classes include non-traditional investment avenues such as global The uncertainty across asset classes is driving investors to look for non-volatile investments that have.

0 Response to "Alternative Assets"

Posting Komentar